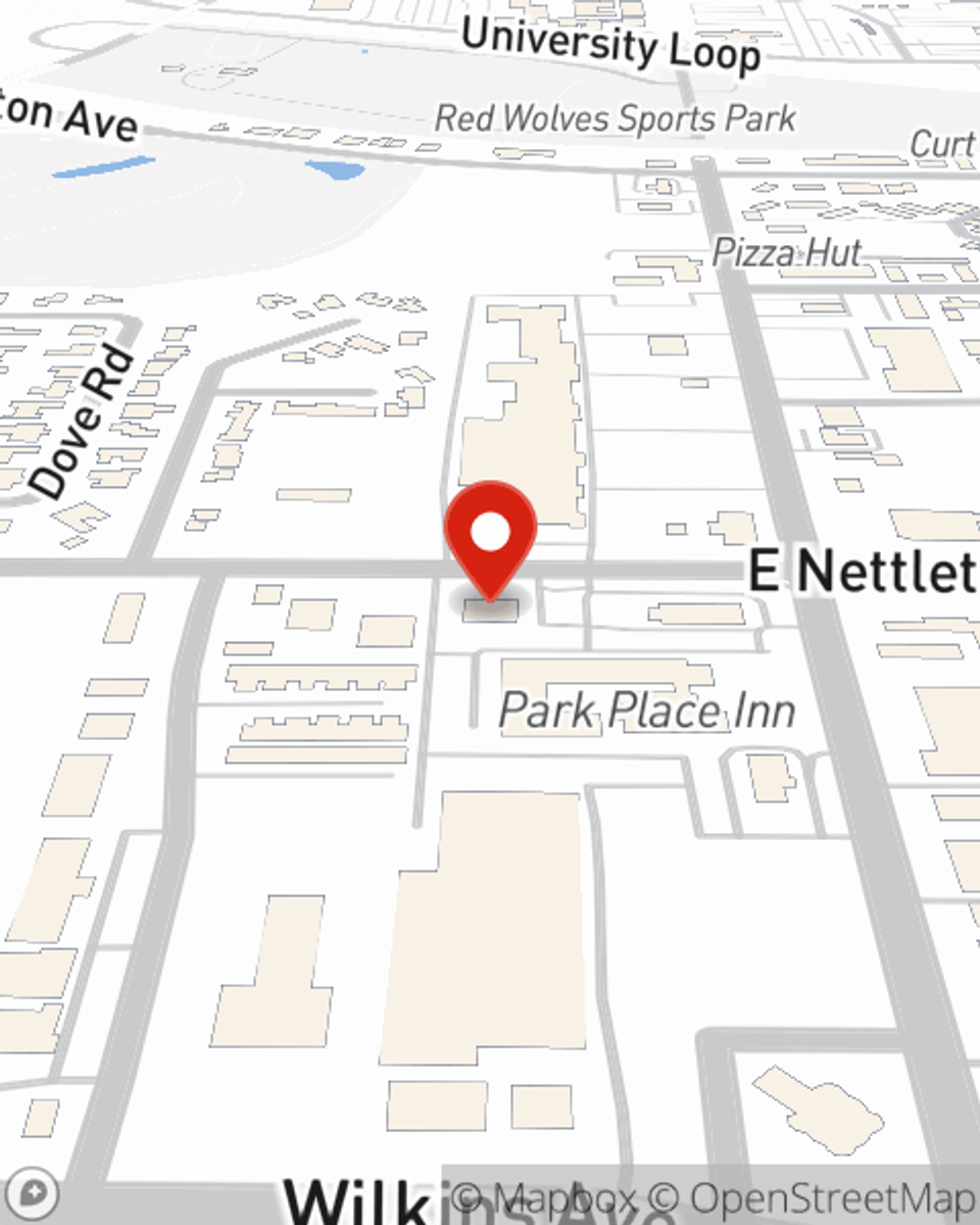

Life Insurance in and around Jonesboro

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

It may make you uncomfortable to contemplate when you pass away, but preparing for that day with life insurance is one of the most significant ways you can demonstrate love to your loved ones.

Coverage for your loved ones' sake

Life won't wait. Neither should you.

Their Future Is Safe With State Farm

The beneficiary designated in your Life insurance policy can help cover bills and other expenses for your family when you pass away. The death benefit can help with things such as utility bills, rent payments or your funeral costs. With State Farm, you can rely on us to be there when it's needed most, while also providing sensitive, responsible service.

If you're looking for reliable coverage and caring service, you're in the right place. Call or email State Farm agent Rob Taylor today to discover which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Rob at (870) 520-6161 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.